can you pay california state taxes in installments

This includes if you have a debt less than 10000 but dont qualify for a. Per State law we mail all property tax.

California State Tax Software Preparation And E File On Freetaxusa

I have installments set up for my federal taxes but I did not see an option for California state taxes.

. Youre able to pay the full amount in five. Box 2952 Sacramento CA 95812-2952. Can you pay California state taxes in installments.

Your tax amount due is less than 25000. If you owe taxes and cant pay them you can file for a state tax installment. To facilitate taxpayers to make instalment applications the Inland Revenue Department provides.

You may be eligible for an installment agreement if. Youll need to meet some basic eligibility. Amount due is less than 25000.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Yes California offers taxpayers the option to set up a California state tax payment plan. Furthermore the IRS must conclude from the information you provide that you are unable to pay the tax in full.

75000 if marriedRDP filing separately. The Treasurer and Tax Collector mails the Annual Secured Property Tax Bills each year in October to every owner listed on the Secured Tax Roll. It may take up to 60 days to process your request.

The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been. Then you must base. Can You Pay California State Taxes in Installments.

If youre required to make estimated tax payments and your prior year California adjusted gross income is more than. If your tax debt is up to 50000 you can apply for a streamlined installment agreement. By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO.

If youre applying for an installment plan for personal taxes you must meet certain eligibility criteria. You can pay the amount in 60 months or less. Can You Make Payments on California State Taxes.

An application fee of 34 will be. How to Pay Self-Employed Tax Instalments to the CRA in Canada. In most cases states allow for a payment plan to be developed between the taxpayer and the state.

You must also agree to comply with all tax laws for the duration of.

California Title Company San Diego Ca Facebook

How Much Tax Do You Pay When You Sell Your House In California Property Escape

Nc Tax Payment Plan Forms Documentation And How To Apply

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition How To File

California Property Tax Calendar Escrow Of The West

Estimated Tax Payment Due Dates For 2022 Kiplinger

I Owe California Ca State Taxes And Can T Pay What Do I Do

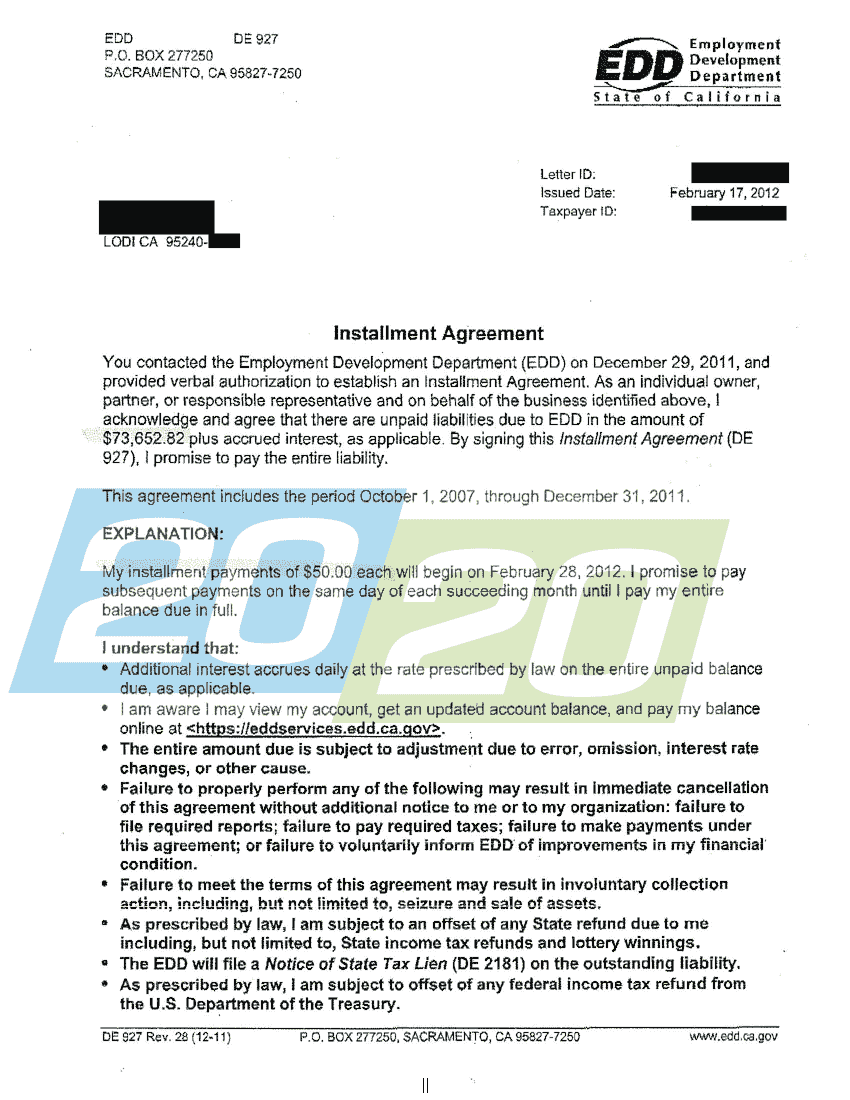

State Accepts Payment Plan In Lodi Ca 20 20 Tax Resolution

Irs Accepts Installment Agreement In San Francisco Ca 20 20 Tax Resolution

Favorable California Pass Through Entity Tax Changes

Property Taxes Department Of Tax And Collections County Of Santa Clara

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Irs Tax Payment Plans Installments Or Offer In Compromise

Irs Accepts Installment Agreement In Santa Maria Ca 20 20 Tax Resolution

Comments

Post a Comment